The Finance Minister has proposed major tax reforms in the new tax regime to reduce the tax burden on hard-working middle class during her Budget speech. The increase in tax exemption limit from ₹5 lakh to ₹7 lakh will bring cheer to many taxpayers. "Currently, those with income up to ₹ 5 lakh do not pay any income tax in both old and new tax regimes. I propose to increase the rebate limit to ₹7 lakh in the new tax regime. Thus, persons in the new tax regime, with income up to ₹7 lakh will not have to pay any tax," the FM said in her Budget speech.

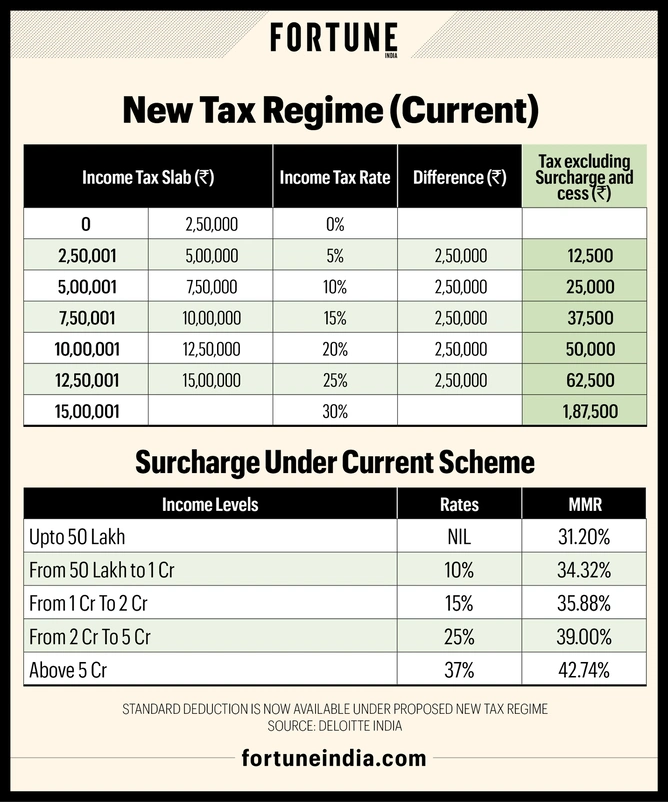

Reducing the number of tax slabs to five, the FM also hiked the basic exemption limit from ₹2.5 lakh to ₹3 lakh under the new income tax regime. The government extended the benefit of standard deduction to the new tax regime. Finance minister has also proposed to make the new income tax regime the default tax regime. However, individuals will have an option to continue with the old income tax regime. The government has reduced the surcharge of the highest rate from 37% currently to 25% in the new tax regime.

All the tax reforms were announced under the new tax regime which was introduced by the FM with six income slabs starting from ₹2.5 lakh in 2020. No changes were made in the old tax regime which allows various deductions including deductions under Section 80C of the Income Tax Act.

How much do you save under new proposed tax regime?

Under the current new tax regime where a taxpayer with an income level of ₹7.5 lakh has to pay ₹39,000 as tax, the taxpayer under the new proposed tax regime will need to pay no tax. A taxpayer with an income of ₹10 lakh is supposed to pay tax worth ₹78,000. However, the new proposed tax regime will save him or her ₹23,400. The taxpayer under the new proposed tax regime will have to shell out only ₹54,600. Similarly, a taxpayer with an income level of ₹20 lakh will save ₹54,600 under the new proposed tax regime.

When compared with the old tax regime, income tax rates under the new proposed tax regime are undoubtedly higher, says Aarti Raote of Deloitte India. It is not feasible to compare the two tax regimes. "The old tax regime and the simplified new proposed tax regimes are difficult to compare due to various deductions availed by different individuals. An individual taxpayer needs to check for himself which one saves him more tax," says Raote. The difference in income tax rate between the old tax regime and the new proposed tax regime has narrowed after the Budget proposals, she adds.

With an endeavour to improve taxpayer services, the Finance Minister during her Budget Speech also announced rollout of a next-generation Common Income Tax Return Form for taxpayer convenience.